Table of Contents

Tata Consumer Business Overview

Tata Consumer is one of the leading companies of the Tata Group, with a presence in the food and beverages business in India and internationally. It is the second-largest tea company globally and has a significant market presence and leadership in many markets. In addition to South Asia (mainly India), it is in various other geographies including Canada, the UK, North America, Australia, Europe, the Middle East, and Africa.

The story of Tata Consumer Products has always been one of continuous transformation, fueled by innovation and agility to meet evolving consumer needs and aspirations. As an integrated F&B company, backed by the Tata group’s strong heritage, it aspires for a larger share of the FMCG world.

Tata is the largest salt brand in India, the 2nd largest Tea brand in India, 3rd largest tea company in the UK, Largest tea brand in Canada.

Business Performance

Packaged Beverages Performance

• Tea delivered a four-year CAGR of 9%.

• It maintained its market leadership in tea in the E-commerce channel for the 36th consecutive month.

• Both its largest brands, Tata Tea Premium, and Tata Tea Agni, recorded strong value growth during the year.

• Coffee revenue grew by 45% YoY.

• Tata Consumer launched Tetley Premium Black Leaf Tea with added long leaves and Tata Coffee Quick Filter Range of Decoction.

• Launched Tea Gold Vita Care, a vitamin-enriched black tea, along with Immuno Chai, catering to health and wellness trends.

Packaged Foods Performance

• Salt revenue grew by 9% during the year, recording the 4-year revenue CAGR of salt at 17%.

• Value-added salts grew by 34% and their contribution to the overall salt business was 9%.

• During the year, the contribution from brands outside the classic Tata Salt (Orange bag) improved, accounting for over 12% of the salt business.

• Tata Sampann delivered yet another strong year, growing by 45% YoY, with robust volume growth. The four-year revenue CAGR stands at 31%, in line with our targets.

• By leveraging Tata Sampann’s equity, it entered a high-value, trust deficit category during the year such as Saffron, and expanded the Dry Fruits range.

• Tata Soulfull entered new categories with exciting new launches, expanding its total addressable market. Key launches during the year were No Maida Choco Stix, NutriDrink+, Millet Granola, and Tata Soulfull Oats+.

Tata Starbucks (50:50 JV)

• During the year, it added 95 new stores and entered 20 new cities during the year.

• Store expansion included expansion into Tier 2 cities, introducing more drive-thus, extending presence in airports, and enhancing 24-hour store footprint.

• Partnered with Netflix India to collaborate on the movie ‘Archies’ for new Christmas Promotional drinks.

Capital Foods Acquisitions

The acquisitions of Capital Foods (owner of brands Ching’s Secret and Smith and Jones) and Organic India fit seamlessly into its identified platforms and would aid in building a robust portfolio of high-growth, high-margin products. With Tata Sampann, Ching’s Secret, and Smith and Jones, it now cater to all the major cuisine blocks and a wide gamut of the Indian culinary palate.

Tata Consumer Financial Performance

| FY 2022 | FY 2023 | FY 2024 | |

|---|---|---|---|

| Revenue | 12,425 | 13,783 | 15,206 |

| Expense | 10,707 | 11,927 | 12,922 |

| OPM (%) | 14% | 13% | 15% |

| Net income | 1,015 | 1,320 | 1,215 |

| EPS | 9.78 | 12.48 | 11.63 |

Tata Consumer Financial Ratios

| PE Ratio | ROCE | ROE | PEG Ratio |

| 90.7 | 10.6 % | 12.0 % | 3.36 |

| Book Value | ROA | Debt to equity | Piotroski score |

| ₹ 162 | 5.61 % | 0.22 | 5.00 |

Tata Consumer Shareholding Pattern

Check out the last 3-year trend of the shareholding Pattern.

| Mar 2022 | Mar 2023 | Mar 2024 | |

|---|---|---|---|

| Promoters | 34.72% | 34.44% | 33.55% |

| FIIs | 17.17% | 19.44% | 18.23% |

| DIIs | 13.71% | 15.85% | 17.39% |

| Public | 26.20% | 24.65% | 23.58% |

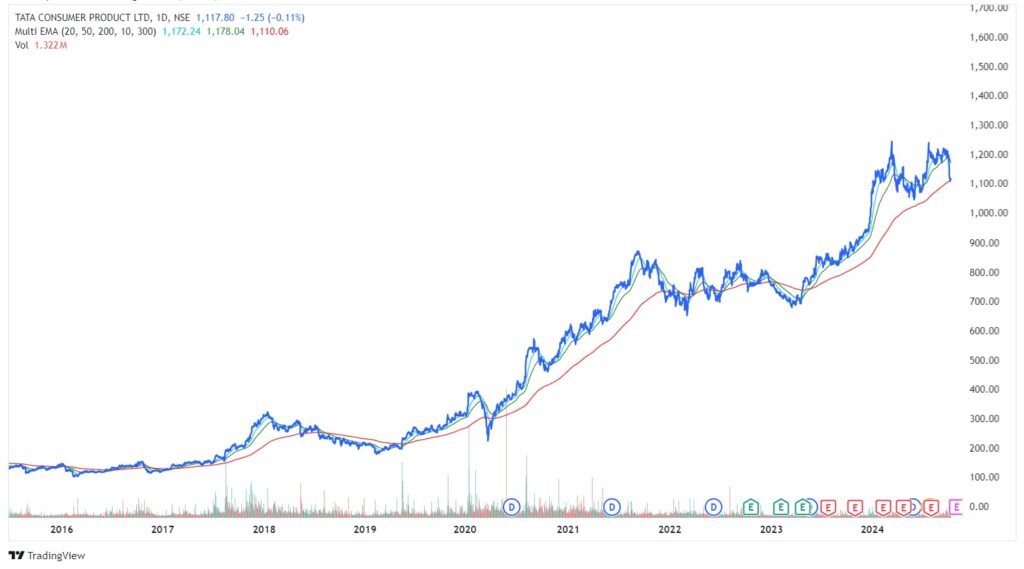

Tata Consumer Stock Price

Tata Consumer Peer comparison

| PE ratio | ROCE % | OPM % | |

|---|---|---|---|

| Tata Consumer | 90.68 | 10.65 | 15.21 |

| CCL Products | 38.77 | 12.39 | 16.93 |

| Vintage Coffee | 95.99 | 8.94 | 17.77 |

Indian Stock market has grown over the last couple of decades. However, little has gone towards bolstering the participation of retail investors in the market. Through its unbiased approach of dissecting the prevalent challenges and finding ways for small investors to make money, Stock Market Dekho aims to help individual investors along their stock market journey.

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.

Contact Us:- admin@stockmarketdekho.in

Pages

Follow us

Proudly powered by WordPress