Table of Contents

Adani Enterprises Business Overview

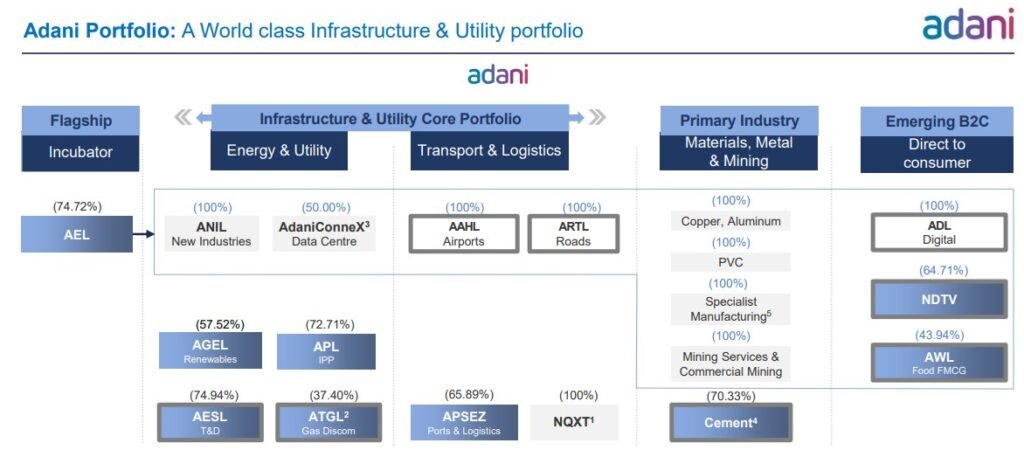

Adani Enterprises is the flagship company of the Adani Group. It kind of acts like an incubator for its new businesses, As a part of the Adani Group of companies, Adani Enterprises Limited is recognized as India’s largest listed business incubator, with a track record of incubating assets critical to the nation’s present and future let’s check out its business,

So, the Flagship company has business interests in various economic areas such as mining, integrated resources management (IRM), infrastructure such as airports, roads, rail/ metro, water, data centers, solar manufacturing, agro, and defense.

As of now, Adani Enterprises is nurturing a business portfolio of a diversified mix from energy to retail. It marks a balanced combination of well-established ventures and emerging enterprises. With strategic investments aimed at nurturing the next level of the nation’s growth, its business portfolio is designed to deliver holistic long-term stakeholder value. Let’s check out its portfolio:

Adani Enterprises is setting up a green hydrogen ecosystem with the objective of incubating, building, and developing an end-to-end integrated ecosystem for the manufacturing of green hydrogen, which includes manufacturing renewable energy equipment such as wind and solar modules to reduce the cost of renewable power,

It is leveraging the Group’s facilities at Mundra to set up this ecosystem. AEL is doing this under Adani New Industries Ltd. (ANIL), its new initiative.

Adani Enterprises is also developing data centers Adani Connex with an aim to retain and drive a data center platform that empowers digital India, and also nurturing other new businesses like Adani Roads Transport, Adani Digital Labs, Adani Defence Systems and Technologies, and any other projects.

Strategic Priorities Incubation Approach:

1. Nurturing innovation and new ventures Operational Excellence

2. Streamlining processes and maximizing efficiency Construction Excellence

3. Timely delivery with superior quality Synergies Across Businesses

4. Collaborating for mutual benefits Stakeholder Value Enhancement

5. Prioritising stakeholder needs and delivering sustainable value

Check Out: Trade Together, a Flagship program

Adani Enterprises Financial Performance

Whatever visionary story a company tells, if it’s not generating cash it is like building castles in the air. Let’s check out AEL’s last 3 years’ Financials trends.

| FY 2022 | FY 2023 | FY 2024 | |

|---|---|---|---|

| Revenue | 69,420 | 127,540 | 96,421 |

| Expense | 65,707 | 118,722 | 85,044 |

| OPM (%) | 5% | 7% | 12% |

| Net income | 788 | 2,422 | 3,335 |

| EPS | 7.06 | 21.61 | 28.42 |

Adani Enterprises Financial Ratios

| PE Ratio | ROCE | ROE | PEG Ratio |

| 82.5 | 19.87 % | 9.73 % | 1.93 |

| Book Value | ROA | Debt to equity | Piotroski score |

| ₹343 | 2.39% | 1.67 | 6.00 |

Adani Enterprises Shareholding Pattern

| Mar 2022 | Mar 2023 | Mar 2024 | |

|---|---|---|---|

| Promoters | 74.92% | 69.23% | 72.61% |

| FIIs | 16.62% | 17.75% | 14.41% |

| DIIs | 5.69% | 5.15% | 5.77% |

| Public | 2.77% | 7.87% | 7.22% |

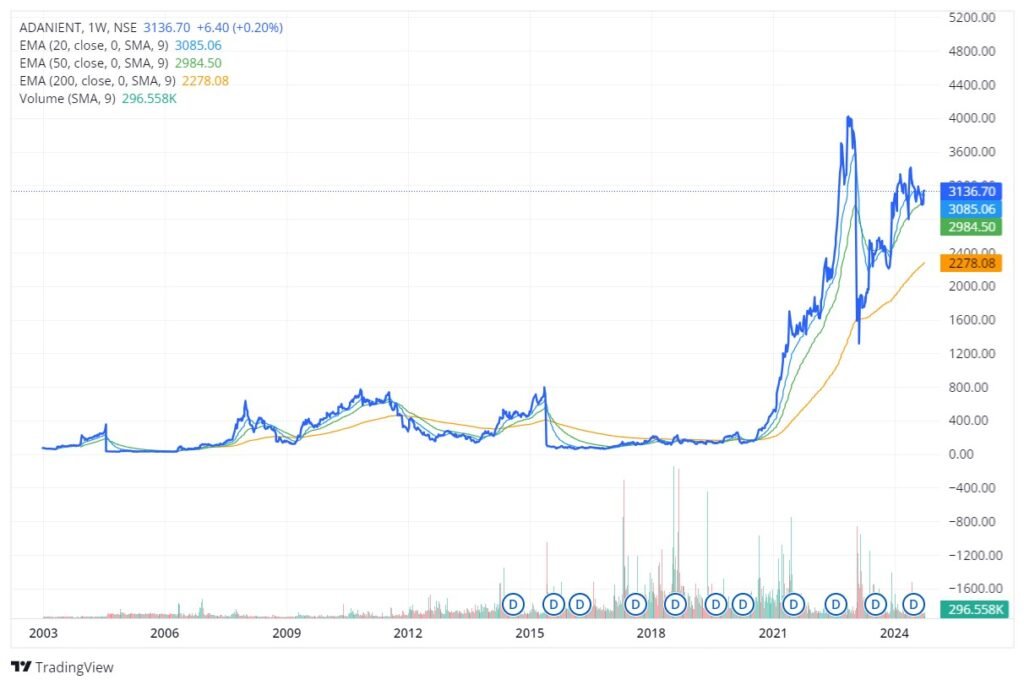

Adani Enterprises Stock Price Performance

Adani Enterprises Peer comparison

| PE ratio | ROCE % | OPM % | |

|---|---|---|---|

| Adani Enterprises | 82.54 | 9.87 | 12.28 |

| Aegis Logistics | 44.76 | 14.74 | 14.65 |

| Cello World | 57.53 | 36.28 | 25.34 |

Indian Stock market has grown over the last couple of decades. However, little has gone towards bolstering the participation of retail investors in the market. Through its unbiased approach of dissecting the prevalent challenges and finding ways for small investors to make money, Stock Market Dekho aims to help individual investors along their stock market journey.

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.

Contact Us:- admin@stockmarketdekho.in

Pages

Follow us

Proudly powered by WordPress