Table of Contents

Axis Bank Business Overview

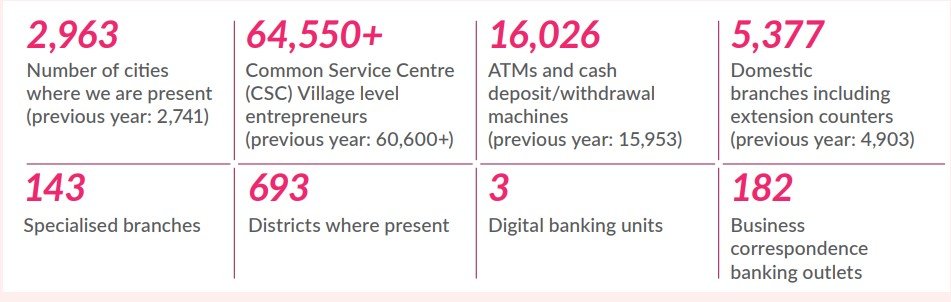

Axis Bank Limited is a private-sector bank. It has the third-largest network of branches(5,377) among private sector banks and an international presence through branches in DIFC (Dubai) and Singapore along with representative offices in Abu Dhabi, Sharjah, Dhaka, and Dubai, and an offshore banking unit in GIFT City.

The bank has delivered strong growth across our focused segments, led by our drive to build granularity across businesses and a strong emphasis on execution.

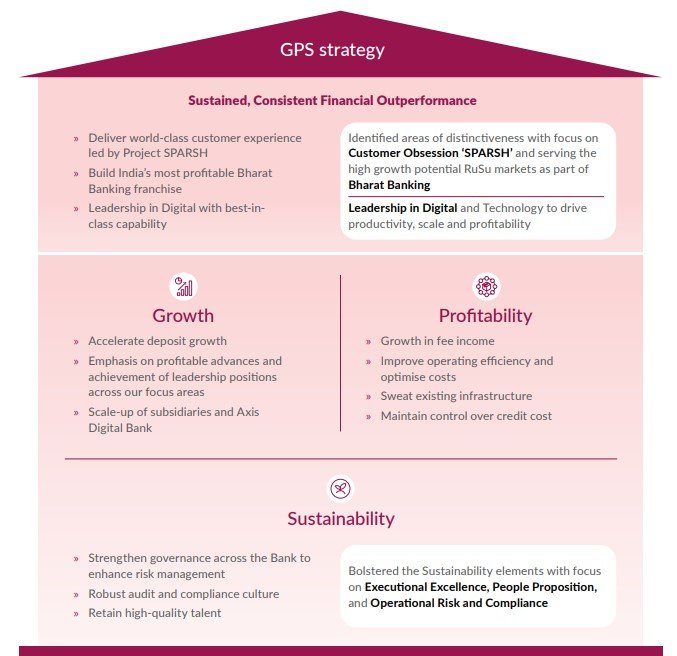

Five years ago, Axis launched the ‘Growth, Profitability, and Sustainability (GPS)’ strategy, also known as the ‘House of GPS’. Throughout the past few years, its GPS strategy, centered on customers and people, has set it on the path of predictable and sustained high performance.

Axis Bank Key Highlights

➢ Market Leadership :

- 3rd largest private sector bank in India.

- 4th largest issuer of credit cards.

- 19.8% market share in FY24.

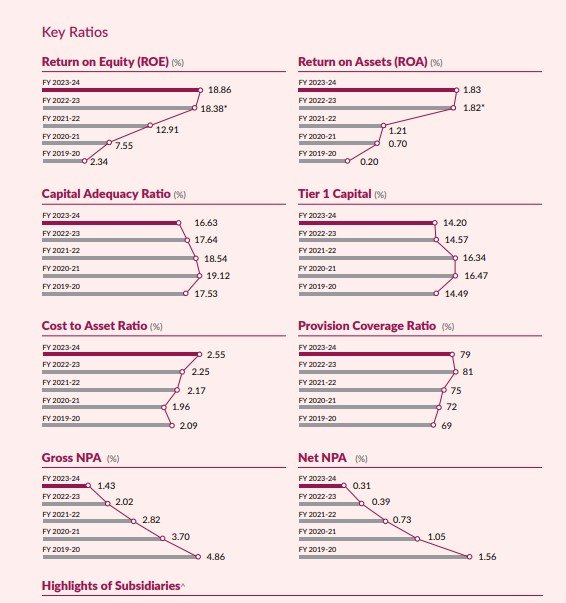

➢Key Ratios:

- Capital Adequacy Ratio – 16.63%

- Net Interest Margin – 4.07%

- Gross NPA – 1.43 %

- Net NPA – 0.31%

- CASA Ratio – 43%

➢ Digital Banking Initiatives:

96% of Digital transactions. 87% of Credit cards issued, 70% of new savings accounts, 74% of New MF SIP Volume, and 53% of Personal loans disbursed were sourced digitally in FY24.

➢ Revenue Mix:

- Treasury: ~15%

- Net NPA ratio improved by 14 bps YoY to 0.57%.

- Slippage ratio improved by 10 bps YoY to 0.84%.

- Provision Coverage Ratio (PCR) including AUCA at 91.76%, excluding AUCA at 74.41%.

➢Capital Adequacy:

- Capital adequacy ratio at 13.86%, CET-1 ratio at 10.25%, well above regulatory requirements.

- Sufficient headroom for normal business growth.

➢International Business

The bank has a global footprint with 233 branches/offices in 32 countries. It is in the USA, Canada, Brazil, Russia, Germany, France, Turkey, Australia, Bangladesh, Nepal, Sri Lanka, and other countries.

Presently, Overseas business accounts for 3% of total deposits and 13% of total advances.

Axis Bank Financial Performance

| FY 2022 | FY 2023 | FY 2024 | |

| Revenue | 289,973 | 350,845 | 439,189 |

| Expense | 197,349 | 204,303 | 239,750 |

| FM(%) | -22% | -12% | -14% |

| Net income | 37,183 | 57,750 | 69,543 |

| EPS | 39.64 | 62.35 | 75.17 |

Axis Bank Key Financial Ratios

| ROCE | PE Ratio | ROE | PEG Ratio |

| 6.16 % | 9.62 | 17.3 % | 0.10 |

| Book Value | ROA | Debt to equity | |

| ₹ 465 | 1.10 % | 13.5 |

Axis Bank Shareholding Pattern

| Mar 2022 | Mar 2023 | Mar 2024 | |

|---|---|---|---|

| Promoters | 9.70% | 8.16% | 8.22% |

| FIIs | 46.93% | 49.05% | 53.84% |

| DIIs | 30.50% | 32.01% | 30.12% |

| Public | 12.87% | 10.79% | 7.81% |

Axis Bank Price Chart

Axis Bank Peer comparison

| PE ratio | ROCE % | OPM % | |

| HDFC Bank | 18.33 | 7.67 | 33.60 |

| ICICI Bank | 18.33 | 7.60 | 34.44 |

| Axis Bank | 13.72 | 7.06 | 62.96 |

| Kotak Bank | 19.00 | 7.86 | 15.88 |

| IndusInd Bank | 12.41 | 7.93 | 60.48 |

| IDBI BANK | 15.05 | 6.23 | 68.52 |

| YES Bank | 49.60 | 5.83 | 58.49 |

| Industry Avg. | 11.85 | 7.07 | 55.35 |

Indian Stock market has grown over the last couple of decades. However, little has gone towards bolstering the participation of retail investors in the market. Through its unbiased approach of dissecting the prevalent challenges and finding ways for small investors to make money in the market, Stock Market Dekho aims to help individual investors along their stock market journey.

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.

Contact Us:- admin@stockmarketdekho.in

Pages

Follow us

Proudly powered by WordPress