Table of Contents

Britannia Business Overview

Britannia Industries is one of India’s leading food companies with a 100-year legacy and annual revenues of over Rs. 9000 Cr. Britannia is among the most trusted food brands and manufactures India’s favorite brands like Good Day, Tiger, NutriChoice, Milk Bikis, and Marie Gold which are household names in India. Britannia’s product portfolio includes Biscuits, Bread, Cakes, Rusk, and Dairy products including Cheese, Beverages, Milk, and Yoghurt.

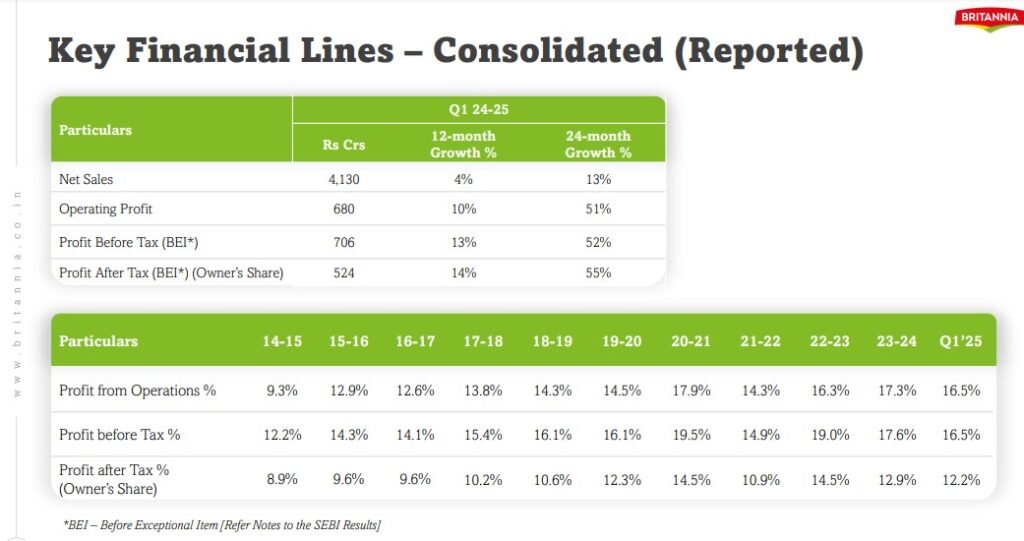

Britannia’s consolidated revenue from operations and operating profit grew at 2.9% and 10.1% in FY 2023-24 compared to the previous year.

To ensure steady growth the company has embarked on a transformation journey driven by strategic initiatives, operational enhancements, and technological advancements.

During the year, Britannia has:

• Entered New Categories and launched New-ToMarket Innovations toward becoming a ‘Global Total Foods Company’.

• Leveraged digitalization to strengthen its distribution, enhance marketing initiatives, and improve efficiency across all functions.

• Commissioned a greenfield factory at Bihta, Bihar to enhance its technologically superior capabilities.

• Strengthened its Environmental, Social, and Governance (‘ESG’) Initiatives.

Britannia has leveraged its R&D capabilities to launch 22 innovative products during the year. In its endeavor to meet the increasing consumer preference for healthy snacking, it launched Makhana (Fox Nuts) under the Brand ‘Better Snack Co’, Energy and Protein Bars under the brand ‘Be You’, and also expanded its Good Day portfolio with Good Day Fruit & Nut and Good Day Butter Jeera.

Britannia is expanding its international presence, it is largely centered around the Middle East, Americas, Africa, and Asia Pacific. The business environment in these geographies is highly competitive with the presence of large local and international players.

Business Strategy

1. Bakery Business

• Biscuit: Scale up distribution for key brands (Good Day), introduction of new products.

• Cake: During the year, Britannia has introduced Veg Layer Cake at `5 and also Plum Cakes at affordable price points. Further, it has entered the growing large pack segment in Slice Cakes with English Tea and Choco Chip Orange cakes.

•Rusk: To deliver quality products at competitive prices, the Company expanded its manufacturing capacity

2. Dairy Business

The company’s strategy is to continue its focus on the core brands as well as build a portfolio to cater to various palates, tastes, and preferences. During the year, it launched ‘Britannia The Laughing Cow Cheese’ according to the Joint Venture Arrangement with Bel SA, a renowned French cheese maker. As part of this Joint Venture, the company also launched first-in-category innovations, Cheese Triangles and Creamy Cheese Sachets in India.

Britannia Financial Performance

| FY 2022 | FY 2023 | FY 2024 | |

|---|---|---|---|

| Revenue | 14,136 | 16,301 | 16,769 |

| Expense | 11,935 | 13,470 | 13,603 |

| OPM (%) | 16% | 17% | 19% |

| Net income | 1,516 | 2,316 | 2,134 |

| EPS | 63.31 | 96.39 | 88.84 |

Britannia Financial Ratios

| PE Ratio | ROCE | ROE | PEG Ratio |

| 67.9 | 48.9 % | 57.1 % | 5.19 |

| Book Value | ROA | Debt to equity | Piotroski score |

| ₹ 164 | 23.2 % | 0.52 | 7.00 |

Britannia Shareholding Pattern

Check out the last 3-year trend of the shareholding Pattern.

| Mar 2022 | Mar 2023 | Mar 2024 | |

|---|---|---|---|

| Promoters | 50.55% | 50.55% | 50.55% |

| FIIs | 17.17% | 19.44% | 18.23% |

| DIIs | 7.94% | 14.22% | 15.63% |

| Public | 24.35% | 15.79% | 15.57% |

Britannia Stock Price

Britannia Peer comparison

| PE ratio | ROCE % | OPM % | |

|---|---|---|---|

| Britannia | 67.88 | 48.92 | 18.98 |

| Nestle India | 80.40 | 169.08 | 24.26 |

Indian Stock market has grown over the last couple of decades. However, little has gone towards bolstering the participation of retail investors in the market. Through its unbiased approach of dissecting the prevalent challenges and finding ways for small investors to make money, Stock Market Dekho aims to help individual investors along their stock market journey.

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.

Contact Us:- admin@stockmarketdekho.in

Pages

Follow us

Proudly powered by WordPress