Table of Contents

HDFC Bank Business Overview

HDFC Bank Limited (HDFC) is an Indian banking and financial services company headquartered in Mumbai. It is India’s largest private sector bank by assets and the world’s tenth-largest bank by market capitalization as of May 2024.

As of April 2024, HDFC Bank has a market capitalization of $145 billion, making it the third-largest company on the Indian stock exchanges.

HDFC Bank Merger Outcome

As HDFC Bank completed one year of the merger, it was the largest merger in India’s Finance Sector. The merger’s benefits are achieved through the combined strengths of the two merged entities, the home loan expertise of erstwhile HDFC Limited, and the extensive distribution franchise of HDFC Bank.

Today, most of its branches sell home loans, including those in semi-urban and rural locations. As the nation’s growth story unfolds, HDFC Bank is prepared to reap the benefits of this historic combination.

HDFC Bank’s Future Strategy

The Indian economy is positioned for growth, driven by strong fundamentals, a favorable policy environment, and a youthful demographic with about 65 percent of the population under 35 years of age.

The bank plans to capitalize on this opportunity through consistent innovation in its offerings and technological capabilities. It focuses on these Strategies:

➢ Focusing on Micro-markets – HDFC Bank is transforming branch banking into a multi-format model based on a granular micro-market approach.

➢ Digital-led Service – HDFC Bank focuses on building a paperless retail experience through customer-centric digital journeys that make banking simple.

➢ Payments Business – Its payment business focuses on end-to-end solutions designed to cater to a wide range of customer segments.

➢ Home Loans – The Bank believes that the fundamental demand for housing will continue to be strong in the long run in India due to a favorable environment.

India is expected to have the largest working population by 2050, which is likely to give a major fillip to urbanization in the country. Eight crore families are likely to move from rural areas to cities in the country, increasing the need for housing.

This is an opportunity for the industry and HDFC Bank as it is well-positioned to fulfill the housing dreams of millions. The Bank is committed to offering home loan solutions to diverse income categories.

HDFC Bank Key Highlight

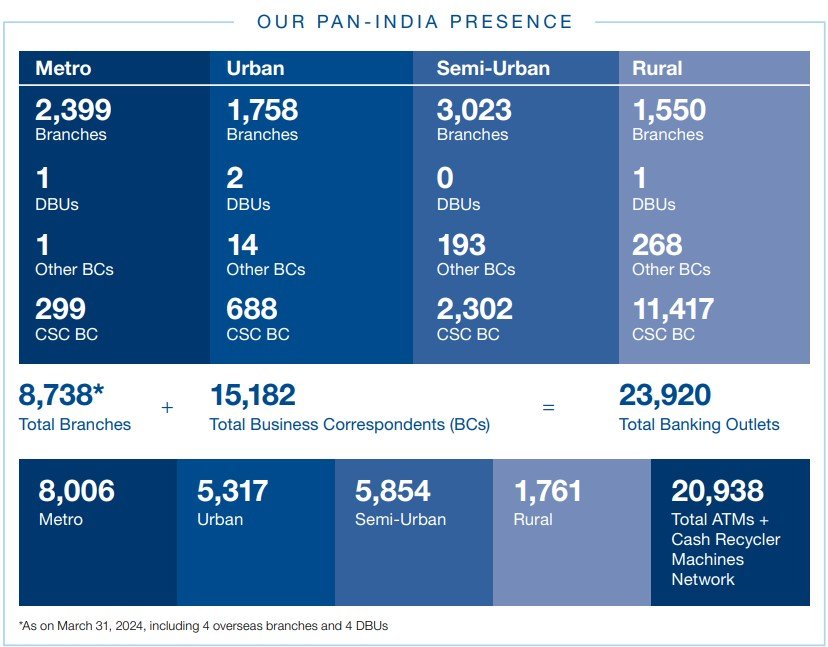

➢HDFC Bank Distribution Network

The bank’s nationwide distribution network spans metro, urban, semi-urban, and rural areas. Through our strategically positioned 8,738 branches.

It has a global footprint by way of representative offices and branches in Bahrain, Hong Kong, the UAE, and Kenya.

➢Key Performance Metrics Q1 2025

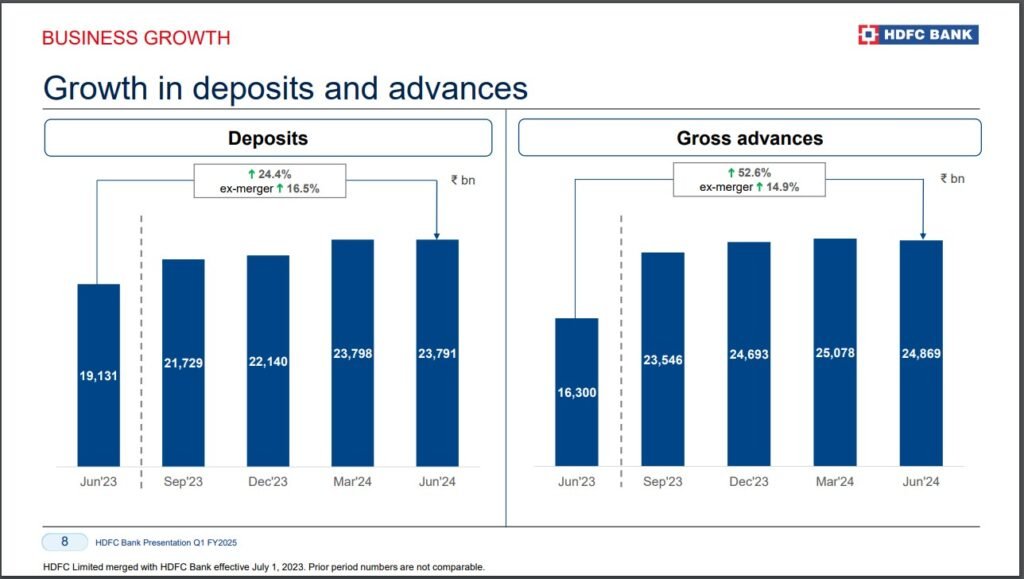

➢ Deposits average ↑ ₹ 1.00 tn in the quarter (↑ 4.6%) ; EOP (↓ 0.03%)

✓ Average CASA ↑ ₹ 0.26 tn (↑ 3.3% ; EOP (↓ 5.0%)

✓ Average Time deposits ↑ ₹ 0.73 tn (↑ 5.2%) ; EOP (↑ 3.0%)

➢ Average advances under management ↑ ₹ 0.20 tn (↑ 0.8%) ; EOP (↓ 0.03%)

➢ Asset quality continues to remain stable; GNPA ratio at 1.33%; ex-agri at 1.16%

➢ PAT for the quarter ₹ 162 bn; RoA of 1.89% and RoE of 15.0%

➢ Consolidated EPS of ₹ 21.7 for the quarter

➢ Capital adequacy ratio is healthy at 19.3%

HDFC Bank Financial Performance

| FY 2022 | FY 2023 | FY 2024 | |

|---|---|---|---|

| Revenue | 135,936 | 170,754 | 283,649 |

| Expense | 56,557 | 63,042 | 174,196 |

| OPM (%) | 15% | 18% | -16% |

| Net income | 38,151 | 46,149 | 65,446 |

| EPS | 68.62 | 82.44 | 84.33 |

Note: After the merger HDFC Bank’s Financial Performance has rocketed as its net income has nearly doubled in FY 2024 as compared to FY 2022, also there is tremendous growth in EPS.

HDFC Bank Key Financial Ratios

| ROCE | PE Ratio | ROE | PEG Ratio |

| 7.67 % | 18.3 | 17.1 % | 0.78 |

| Book Value | R0A | Debt to equity | Piotroski score |

| ₹ 601 | 1.99 % | 6.81 | 5.00 |

HDFC Bank Shareholding Pattern

| Mar 2022 | Mar 2023 | Mar 2024 | |

|---|---|---|---|

| Promoters | 25.78% | 25.59% | 0.00% |

| FIIs | 35.62% | 32.24% | 47.83% |

| DIIs | 24.55% | 28.09% | 33.33% |

| Public | 13.89% | 13.91% | 18.64% |

Note: FIIs and DIIs have increased their Shareholding post-merger, this indicates institutional trust in the bank’s future trajectory.

HDFC Bank Price Chart

Note: HDFC Bank Price has shown tremendous growth in the last decade.

HDFC Bank’s Peer Comparison

| Stock | PE ratio | ROCE % | OPM % |

| HDFC Bank | 18.33 | 7.67 | 33.60 |

| ICICI Bank | 18.33 | 7.60 | 34.44 |

| Axis Bank | 13.72 | 7.06 | 62.96 |

| Kotak Bank | 19.00 | 7.86 | 15.88 |

| IndusInd Bank | 12.41 | 7.93 | 60.48 |

| IDBI BANK | 15.05 | 6.23 | 68.52 |

| YES Bank | 49.60 | 5.83 | 58.49 |

| Industry Avg. | 11.85 | 7.07 | 55.35 |

Note: HDFC Bank is trading on a higher multiple to its industry average.

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.

Indian Stock market has grown over the last couple of decades. However, little has gone towards bolstering the participation of retail investors in the market. Through its unbiased approach of dissecting the prevalent challenges and finding ways for small investors to make money in the market, Stock Market Dekho aims to help individual investors along their stock market journey.

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.

Contact Us:- admin@stockmarketdekho.in

Pages

Follow us

Pingback: Renewable Energy IPOs: NTPC, and ONGC are among five PSUs planning to list their renewable energy arm; check the details