Table of Contents

ICICI Bank Business Overview

ICICI Bank is India’s second-largest private sector bank offering a diversified portfolio of financial products and services to retail, SME, and corporate customers. The Bank has an extensive network of branches, ATMs, and other touch-points. The ICICI group has a presence in businesses like life and general insurance, housing finance, primary dealerships, etc, through its subsidiaries and associates.

During fiscal 2024, the Bank continued to advance in terms of profitability, and its franchise as well as building capabilities for sustainable and resilient growth.

➢International Business

The bank also has an international presence, with branches in the US (New York), Singapore, Bahrain, Hong Kong, Dubai International Finance Centre, South Africa, China, Offshore Banking Unit (OBU), and International Financial Services Centre (IFSC), along with representative offices in the US (Texas and California), UAE, Bangladesh, Malaysia, Nepal, and Indonesia.

The bank also has wholly-owned banking subsidiaries in the UK and Canada, with branches across both countries. ICICI Bank UK also has an offshore branch in Germany.

ICICI Business Strategy

➢Focus on Micro markets: ICICI Bank continues to uphold its customer-centric values through an in-depth analysis of micro markets, leveraging data analytics and market intelligence.

➢Focus on Ecosystems: Its focus is on understanding industry and sector nuances and addressing specific requirements, which help to support businesses at every step of their journey.

➢Collaborations and Partnerships: The Bank has key partnerships with Amazon, MakeMyTrip, and Emirates to offer co-branded credit cards. Amazon Pay credit cards continued to see healthy traction with over four million credit cards issued till March 31, 2024.

➢Approach To Digital, Technology, And Processes: It provides a diverse range of services like mobile banking, internet banking, UPI payments, and digital wallets, the strategy emphasizes accessibility and security for all users.

ICICI Bank’s iMobile Pay app focuses on delivering a seamless, secure, and personalized banking experience. The app prioritizes accessibility with a user-friendly interface for easy navigation and access to a wide range of banking services including account management, fund transfers, bill payments, and investments.

ICICI Bank Key Highlights

➢Key Ratios – FY24

Capital Adequacy Ratio – 16.03%

Net Interest Margin – 4.57%

Gross NPA – 2.30%

Net NPA – 0.44%

CASA Ratio – 39.4%

➢Branch Network

Presently, the bank operates a network of 6,523 branches and 17,190 ATMs across India. 30% of its branches are located in metro cities.

➢ Loan Book FY24

Retail advances account for 54.3% of the total loan book, followed by corporations & others (21.7%), Rural loans (8.3%), Business banking (7.4%), SME(4.9%), and 3.4% overseas books.

➢ Credit Cards

The bank has issued about 1.65 crore credit cards till date. It has also issued co-branded credit cards in partnership with Amazon and has issued 47 lakh credit cards to date. 80% of Credit Cards sanctioned were digitally processed & physically assisted.

➢Digital Payments

1. Market share of UPI: P2M transactions by value was 19.7% on Dec 23.

2. Market share of Electronic toll collections by value was 28.8% in Q3FY24.

ICICI Bank Financial Performance

| FY 2022 | FY 2023 | FY 2024 | |

| Revenue | 95,407 | 121,067 | 159,516 |

| Expense | 80,798 | 87,864 | 99,560 |

| OPM (%) | -28% | -14% | -9% |

| Net income | 26,538 | 35,461 | 46,081 |

| EPS | 36.14 | 48.74 | 63.02 |

Note: ICICI Bank’s Financial Performance has been growing in the last 3 years.

ICICI Bank Key Financial Ratios

| PE Ratio | ROCE | ROE | PEG Ratio |

| 19.5 | 7.60 % | 18.8 % | 0.33 |

| Book Value | ROA | Debt to equity | Piotroski score |

| ₹ 365 | 2.13 % | 6.45 | 6.00 |

ICICI Bank Shareholding Pattern

| Mar 2022 | Mar 2023 | Mar 2024 | |

|---|---|---|---|

| FIIs | 43.95% | 44.16% | 44.77% |

| DIIs | 44.58% | 45.11% | 45.10% |

| Public | 11.23% | 10.48% | 9.84% |

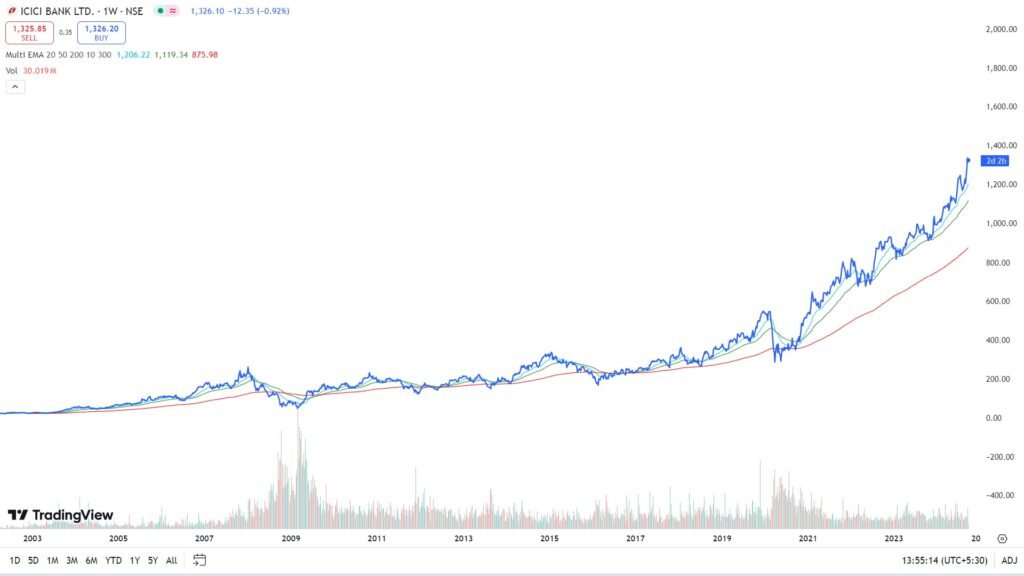

ICICI Bank Stock Price

ICICI Bank’s Peer Comparison

| PE ratio | ROCE % | OPM % | |

| HDFC Bank | 18.33 | 7.67 | 33.60 |

| ICICI Bank | 18.33 | 7.60 | 34.44 |

| Axis Bank | 13.72 | 7.06 | 62.96 |

| Kotak Bank | 19.00 | 7.86 | 15.88 |

| IndusInd Bank | 12.41 | 7.93 | 60.48 |

| IDBI BANK | 15.05 | 6.23 | 68.52 |

| YES Bank | 49.60 | 5.83 | 58.49 |

| Industry Avg | 11.73 | 7.07 | 55.35 |

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.

Indian Stock market has grown over the last couple of decades. However, little has gone towards bolstering the participation of retail investors in the market. Through its unbiased approach of dissecting the prevalent challenges and finding ways for small investors to make money in the market, Stock Market Dekho aims to help individual investors along their stock market journey.

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.

Contact Us:- admin@stockmarketdekho.in

Pages