Table of Contents

IDFC First Bank Business Overview

IDFC First Bank is engaged in the business of Banking Services. The bank was founded by the merger of Erstwhile IDFC Bank and Erstwhile Capital First on December 18, 2018. It has made significant progress on all counts during the last 5 years including Deposits, Loan, Capital, Assets, and Leadership Team Building.

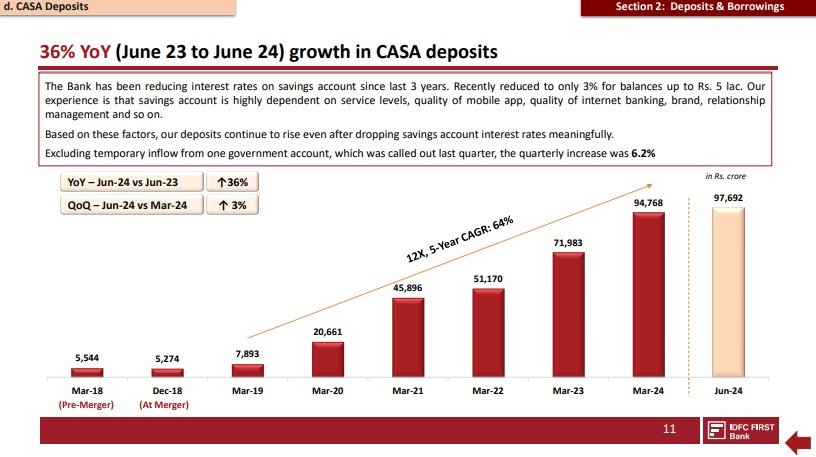

The Bank has been reducing interest rates on savings accounts for the last 3 years. Recently reduced to only 3% for balances up to Rs. 5lac. Its experience is that savings accounts are highly dependent on service levels, quality of mobile apps, quality of internet banking, brand, relationship management, and so on.

Based on these factors, the bank’s deposits continue to rise even after dropping savings account interest rates meaningfully. Excluding temporary inflow from one government account, which was called out last quarter, the quarterly increase was 6.2%

IDFC First Bank Key Highlights

➢ The Bank has built a full Suite of Universal Banking Products including Corporate Lending, Retail Lending Solutions, SME Lending Solutions, NRI Banking, and services like Wealth Management & Distribution.

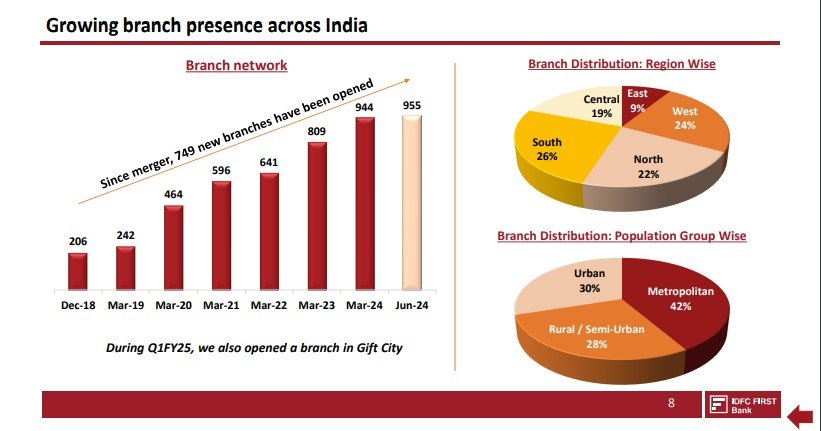

➢ Growing branch presence across India, as there were 206 branches in 20218, since the merger, 749 new branches have been opened totaling up to 955.

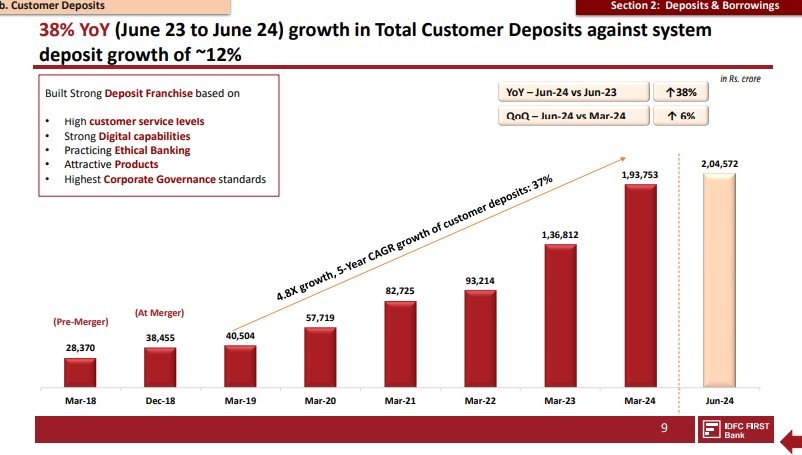

➢ The Bank has grown its customer deposits by 38% YOY, a 4.8X growth from 2019, with a CAGR growth of customer deposits at 37%.

➢ The Bank has a healthy CASA ratio of 46.6%, it has maintained CASA at > 45% for the last 3 years, with a 5-year CAGR growth of 64%.

➢ The Bank’s Long Term Credit Rating has been recently upgraded by CARE, CRISIL, and ICRA from AA (stable) to AA+ (stable).

IDFC First Bank Financial Performance

| FY 2022 | FY 2023 | FY 2024 | |

| Revenue | 17,173 | 22,728 | 30,325 |

| Expense | 12,323 | 13,338 | 17,899 |

| OPM (%) | -15% | -3% | -5% |

| Net income | 132 | 2,485 | 2,942 |

| EPS | 0.21 | 3.75 | 4.16 |

IDFC First Bank Financial Ratios

| ROCE | PE Ratio | ROE | PEG Ratio |

| 6.93 % | 19.1 | 10.1 % | 0.66 |

| Book Value | ROA | D/E | Piotroski score |

| ₹ 45.6 | 1.10 % | 7.79 | 4.00 |

IDFC First Shareholding Pattern

| Mar 2022 | Mar 2023 | Mar 2024 | |

|---|---|---|---|

| Promoters | 36.49% | 39.99% | 37.43% |

| FIIs | 13.48% | 19.31% | 23.65% |

| DIIs | 9.58% | 7.69% | 6.79% |

| Public | 36.24% | 29.05% | 28.38% |

IDFC First Price Chart

IDFC First Bank Peer comparison

| PE ratio | ROCE % | OPM % | |

| IDFC First Bank | 19.1 | 6.93 % | 38.49 |

| HDFC Bank | 18.33 | 7.67 | 33.60 |

| ICICI Bank | 18.33 | 7.60 | 34.44 |

| Axis Bank | 13.72 | 7.06 | 62.96 |

| Kotak Bank | 19.00 | 7.86 | 15.88 |

| IndusInd Bank | 12.41 | 7.93 | 60.48 |

| IDBI BANK | 15.05 | 6.23 | 68.52 |

| YES Bank | 49.60 | 5.83 | 58.49 |

Indian Stock market has grown over the last couple of decades. However, little has gone towards bolstering the participation of retail investors in the market. Through its unbiased approach of dissecting the prevalent challenges and finding ways for small investors to make money in the market, Stock Market Dekho aims to help individual investors along their stock market journey.

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.

Contact Us:- admin@stockmarketdekho.in

Pages

Follow us

Proudly powered by WordPress