Table of Contents

Kotak Bank Business Overview

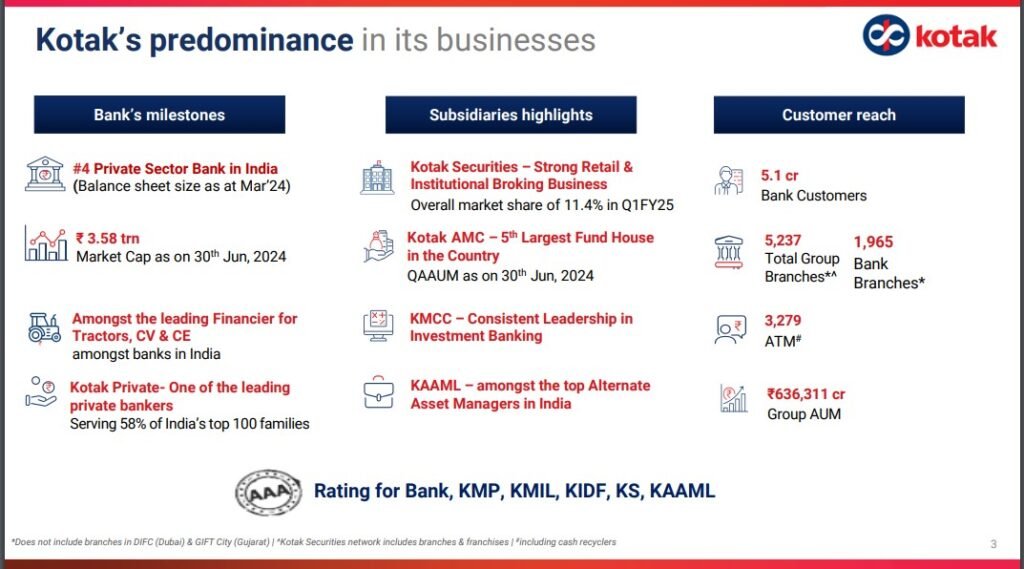

Kotak Mahindra Bank is a diversified financial services group providing a wide range of banking and financial services including Retail Banking, Treasury and Corporate Banking, Investment Banking, Stock Broking, Vehicle Finance, Advisory Services, Asset Management, Life Insurance, and General Insurance.

Kotak Bank Key Highlights

➢Market Share

The company ranks 4th in both deposit and gross advances market share. Its securities broking business held an 11.8% market share in FY24, while the asset management business had a 6.5% market share.

➢Key Ratios

Capital Adequacy Ratio – ~20% in FY24 vs 22.7% in FY22

NIM – ~5.3% in FY24% vs 4.6% in FY22

Gross NPA – 1.39% in FY24 vs 2.34% in FY22

CASA Ratio – 45.5% in FY24 vs 60.7% in FY22

➢ Branch Network

As of FY24, the bank operates 1,900+ branches, 3,200+ ATMs, and 11 currency chests in India vs ~1,700 branches and ~2,700 ATMs in FY23.

West: 31%North: 31%South: 30%East: 8%

➢Customer Base

As of FY24, the bank has a customer base of 5 Cr customers vs 3.27 Cr customers in FY22.

➢ International Footprints

The Bank has a global presence through its subsidiaries in the UK, USA, Gulf Region, Singapore, and Mauritius. It opened its first international branch in 2019 in Dubai.

Kotak Bank Financial Performance

| FY 2022 | FY 2023 | FY 2024 | |

| Revenue | 33,741 | 42,151 | 56,237 |

| Expense | 30,699 | 33,485 | 47,052 |

| FM (%) | -25% | -14% | -24% |

| Net income | 12,089 | 14,925 | 18,213 |

| EPS | 60.91 | 75.13 | 91.62 |

Kotak Bank Financial Ratios

| ROCE | PE Ratio | ROE | PEG Ratio |

| 7.86 % | 19.5 | 15.1 % | 0.95 |

| Book Value | ROA | Debt to equity | Piotroski score |

| ₹ 654 | 2.62 % | 4.00 | 5.00 |

Kotak Bank Shareholding Pattern

| Mar 2022 | Mar 2023 | Mar 2024 | |

|---|---|---|---|

| Promoters | 25.98% | 25.95% | 25.90% |

| FIIs | 40.86% | 39.42% | 37.59% |

| DIIs | 16.60% | 21.31% | 23.40% |

| Public | 16.56% | 13.30% | 13.11% |

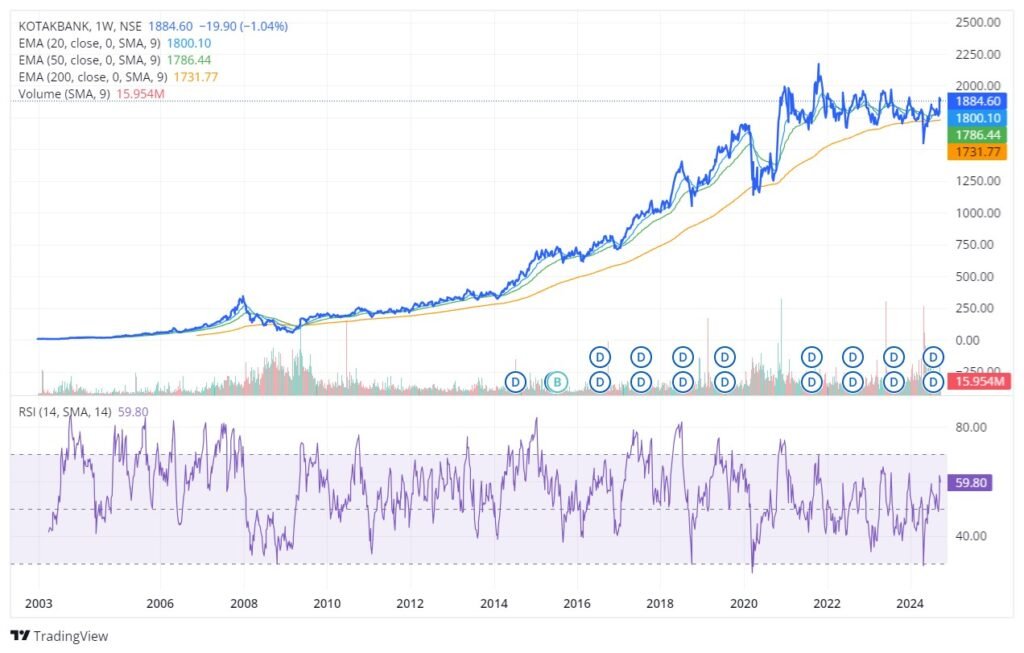

Kotak Bank Price Chart

Kotak Bank Peer comparison

| PE ratio | ROCE % | OPM % | |

| Kotak Bank | 19.5 | 7.86 % | 15.88 |

| HDFC Bank | 18.33 | 7.67 | 33.60 |

| ICICI Bank | 18.33 | 7.60 | 34.44 |

| Axis Bank | 13.72 | 7.06 | 62.96 |

| Kotak Bank | 19.00 | 7.86 | 15.88 |

| IndusInd Bank | 12.41 | 7.93 | 60.48 |

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please get in touch with your adviser before making an investment.

Indian Stock market has grown over the last couple of decades. However, little has gone towards bolstering the participation of retail investors in the market. Through its unbiased approach of dissecting the prevalent challenges and finding ways for small investors to make money in the market, Stock Market Dekho aims to help individual investors along their stock market journey.

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.

Contact Us:- admin@stockmarketdekho.in

Follow us

Proudly powered by WordPress