Table of Contents

SBI Business Overview

State Bank of India is a Fortune 500 company. It is an Indian Multinational, Public Sector banking and financial services statutory body headquartered in Mumbai. It is India’s largest and oldest bank with over 200 years of history.

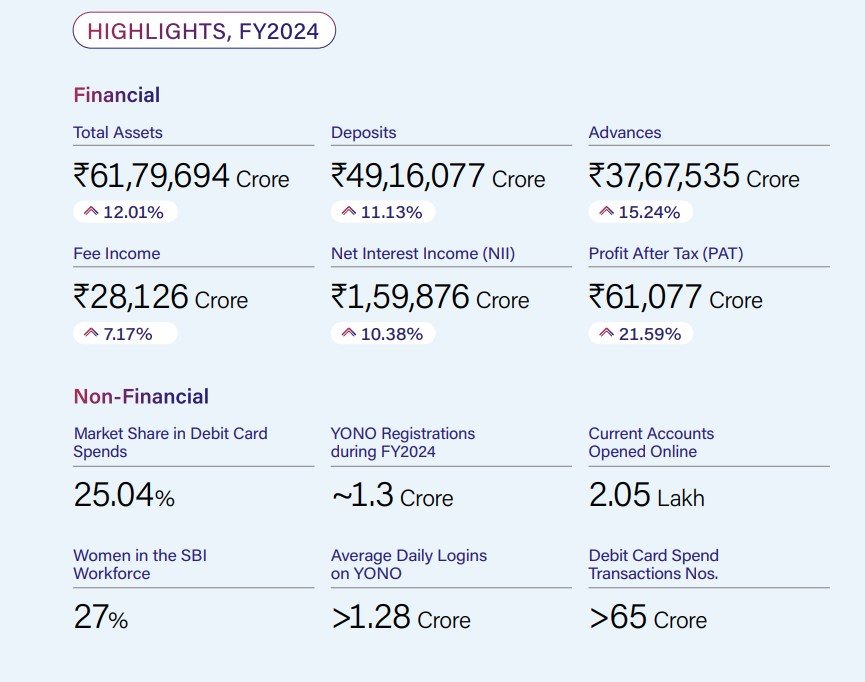

During FY2024, the Bank’s business grew at a faster pace than the previous year, both in deposits and advances. Its balance sheet size has crossed H61 Lakh Crore as of March 2024. The market share of SBI is at 22.55% in Deposits and 19.06% in Advances.

State Bank of India Key Highlights

➢ SBI Key Highlights:

- Net profit of ₹17,035 crores, up 0.90% YoY.

- Operating profit increased by 4.55% YoY to ₹26,449 crores.

- Return on Assets (RoA) at 1.10% and Return on Equity (RoE) at 20.98%.

- Cost to income ratio improved by 95 bps YoY to 49.42%.

- Net Interest Income (NII) grew by 5.71% YoY, driven by improved yields and credit offtake.

➢Deposit and Credit Growth:

- Total deposits grew by 8.18% YoY; term deposits increased by 12.20% YoY.

- CASA deposits rose by 2.59% YoY.

- Domestic advances up by 15.55%, with retail, agri, and MSME advances surpassing ₹21 trillion.

- Retail personal advances at ₹13.7 trillion, growing at 13.60%.

➢ Digital Banking Initiatives:

- Over 8 crore customers registered on YONO, with 63% of regular savings accounts opened via the platform.

- YONO business gained traction with more than 29 lakh users registered.

- Leveraging analytics with significant business underwritten amounting to ₹25,438 crores in Q1FY25.

➢ Asset Quality and Provisions:

- Gross NPA ratio improved by 55 bps YoY to 2.21%, the lowest in over a decade.

- Net NPA ratio improved by 14 bps YoY to 0.57%.

- Slippage ratio improved by 10 bps YoY to 0.84%.

- Provision Coverage Ratio (PCR) including AUCA at 91.76%, excluding AUCA at 74.41%.

➢Capital Adequacy:

- Capital adequacy ratio at 13.86%, CET-1 ratio at 10.25%, well above regulatory requirements.

- Sufficient headroom for normal business growth.

➢International Business

The bank has a global footprint with 233 branches/offices in 32 countries. It is in the USA, Canada, Brazil, Russia, Germany, France, Turkey, Australia, Bangladesh, Nepal, Sri Lanka, and other countries.

Presently, Overseas business accounts for 3% of total deposits and 13% of total advances.

SBI Business Overview

| FY 2022 | FY 2023 | FY 2024 | |

| Revenue | 289,973 | 350,845 | 439,189 |

| Expense | 197,349 | 204,303 | 239,750 |

| FM(%) | -22% | -12% | -14% |

| Net income | 37,183 | 57,750 | 69,543 |

| EPS | 39.64 | 62.35 | 75.17 |

SBI Key Financial Ratios

| ROCE | PE Ratio | ROE | PEG Ratio |

| 6.16 % | 9.62 | 17.3 % | 0.10 |

| Book Value | ROA | Debt to equity | Piotroski score |

| ₹ 465 | 1.10 % | 13.5 | 8.00 |

SBI Shareholding Pattern

| Mar 2022 | Mar 2023 | Mar 2024 | |

|---|---|---|---|

| Promotors | 57.59% | 57.49% | 57.54% |

| FIIs | 9.97% | 9.89% | 11.09% |

| DIIs | 24.66% | 25.20% | 23.96% |

| Public | 7.63% | 7.40% | 7.37% |

SBI Price Chart

SBI Peer comparison

| PE ratio | ROCE % | OPM % | |

| SBI | 9.67 | 6.16 | 47.05 |

| HDFC Bank | 18.33 | 7.67 | 33.60 |

| ICICI Bank | 18.33 | 7.60 | 34.44 |

| Axis Bank | 13.72 | 7.06 | 62.96 |

| Kotak Bank | 19.00 | 7.86 | 15.88 |

| IndusInd Bank | 12.41 | 7.93 | 60.48 |

| IDBI BANK | 15.05 | 6.23 | 68.52 |

| YES Bank | 49.60 | 5.83 | 58.49 |

| Industry Avg. | 11.85 | 7.07 | 55.35 |

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.

Indian Stock market has grown over the last couple of decades. However, little has gone towards bolstering the participation of retail investors in the market. Through its unbiased approach of dissecting the prevalent challenges and finding ways for small investors to make money in the market, Stock Market Dekho aims to help individual investors along their stock market journey.

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.

Contact Us:- admin@stockmarketdekho.in

Follow us